More than 1.2 million employers have now successfully met their automatic enrolment duties and put nearly 10 million staff into a workplace pension.

Workplace saving is now the social norm with 84% of staff now saving, and automatic enrolment has reached steady state with around 100,000 new businesses a year putting staff straight into a pension.

However, automatic enrolment has ongoing tasks which must be completed to ensure employers continue to comply with the law, and staff continue to receive the pensions they are entitled to.

However, automatic enrolment has ongoing tasks which must be completed to ensure employers continue to comply with the law, and staff continue to receive the pensions they are entitled to.

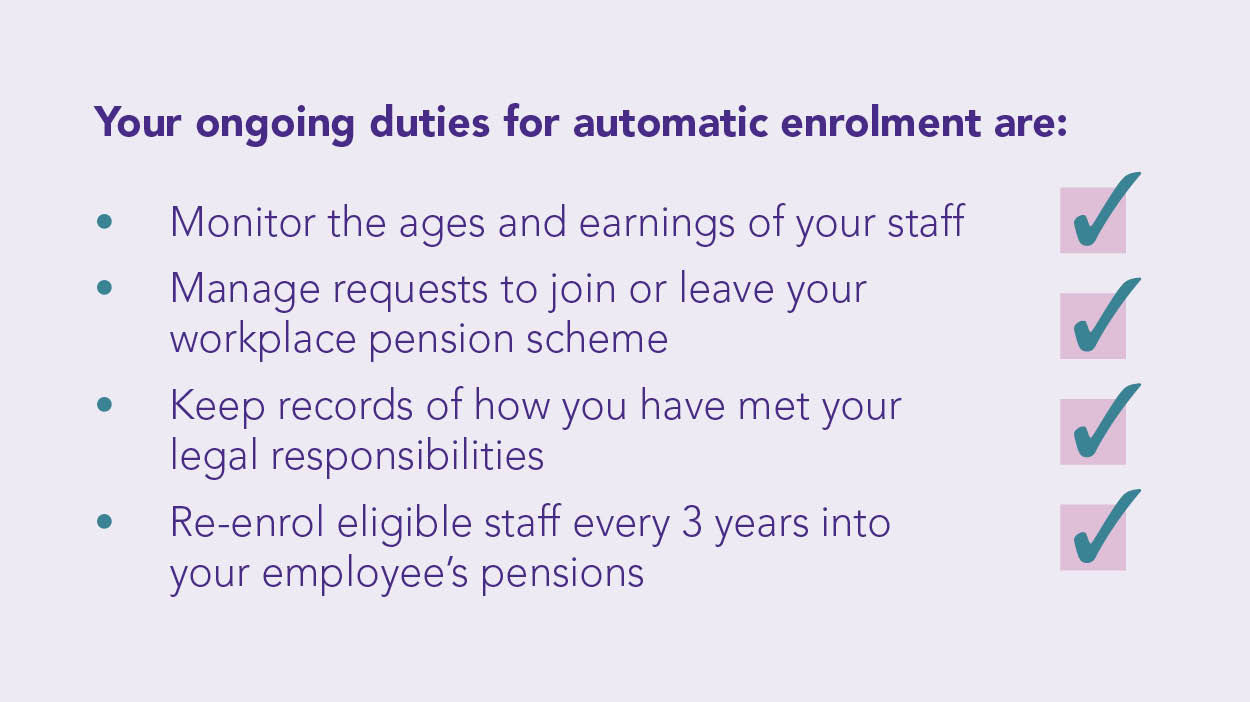

Ongoing duties include monitoring the age and earnings of staff, keeping records, managing requests to leave or join a pension scheme and maintaining pensions contributions.

More information about ongoing duties can be found here.

Every three years, employers must also complete re-enrolment which means enrolling all eligible staff who are not currently members of a workplace pension, into a scheme. They must then complete a re-declaration of compliance.

Last April, the minimum pensions contributions increased from 3% total contribution to 5% and next April it will increase again to 8%. This is a straightforward task for employers, but they should ensure the correct amount is being paid into the pension scheme. The Pensions Regulator has been monitoring compliance with the increase in April through PAYE data provided by HMRC, and indications are that it is very high.

As published in the recent Automatic Enrolment Commentary and Analysis report, compliance with the law is high. The research shows the vast majority of employers are aware of and understand their ongoing duties, find them easier than expected and are confident they can complete them. Most employers spend less than two hours a month on their ongoing tasks and one third use a business adviser.

However, there are a small minority who fail to meet their ongoing duties and The Pensions Regulator will take action, including issuing financial penalties.

There are a number of ways that non compliance can be detected. This includes monitoring contributions to ensure employers are continuing to make the correct payments, alerts from pension schemes, reports from whistleblowers and compliance validation checks.

Between April last year and April this year The Pensions Regulator carried out nearly 2,000 compliance validation exercises, or ‘spot checks’ nationwide. Employers were identified through data and intelligence analysis and scheduled for either desk-based investigation or an inspection in person. Employers targeted included those believed to be non compliant and those where data suggested full compliance.

Between April last year and April this year The Pensions Regulator carried out nearly 2,000 compliance validation exercises, or ‘spot checks’ nationwide. Employers were identified through data and intelligence analysis and scheduled for either desk-based investigation or an inspection in person. Employers targeted included those believed to be non compliant and those where data suggested full compliance.

Where an employer was non compliant, case teams took a positive approach and worked to help them. In many cases, employers welcomed the opportunity to show how they had complied and ask questions to ensure they were carrying out their duties correctly.

The Pensions Regulator understands that most employers want to do the right thing for their staff and they are there to help, but action will be taken where an employer is non compliant to ensure staff receive the pensions they are due and the culture of workplace saving remains strong.

Useful links for employers

AE guide for employers: www.tpr.gov.uk/employers

Ongoing duties guidance: www.tpr.gov.uk/ongoing

Declaration of compliance: www.tpr.gov.uk/declaration